Which large energy companies have split the pie of European funding for ‘green’ hydrogen in the Spanish state?

The distribution of the money destined to finance so-called ‘green’ hydrogen benefits, once again, the big energy and fossil fuel companies. It is not easy to be aware, as tracking these funds is very complex and opaque. The ODG has analysed and collected which companies and projects have received public funding, both from EU funds and from the Spanish state. We denounce the lack of transparency in the destination of considerable public resources (13.8 billion euros in total at European level) and the perpetuation of an energy model that does not address the root causes of the climate emergency.

Since the race to decarbonise and reduce CO₂ emissions began, the countries of the global North have set themselves the goal of no longer being dependent on fossil fuels. Oil, coal and gas, the main energy sources of the current consumption model, are to be quickly replaced by renewable energies such as photovoltaic and wind power. One of the energy carriers that has gained the most traction is hydrogen, which is being promoted as a panacea to tackle the climate crisis. In particular, it is being positioned to feed those energy volumes and uses of industries that renewables cannot cover, such as petrochemicals, fertilisers, steel…

In fact, hydrogen is already being used in these processes, but it is far from being a clean or sustainable energy. Generating ‘green’ hydrogen requires exorbitant amounts of electricity and water. We analysed all this in depth in the report ‘The hydrogen trail’, in collaboration with Ecologistas en Acción. Some of the points where we did the fieldwork in December 2023 reappear: the Bilbao Large Scale Electrolyser, of Petronor/Repsol, and the Catalina project, of CIP, Enagás and Fertiberia. At that time, we wanted to get to know them directly; in the first case, because of the importance in the territory of the promoter company where the Bilbao project is located, and, in the second case, because of the social, environmental, economic, gender and territorial impacts caused by other large projects linked to the current institutional energy transition model.

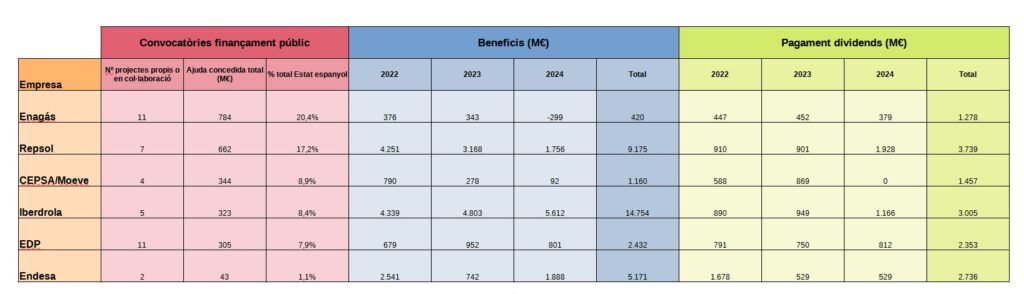

Why are we now analysing the distribution of European and Spanish public funds directed to promote ‘green’ hydrogen? Because we wanted to confirm our initial suspicion: the economic benefits of this public funding will end up in the pockets of the same old people. Of the total of thirteen billion euros, 2.246 billion euros have already been allocated to large energy companies. Those companies that are often responsible for and involved in the current climate crisis. On paper, the aim is to promote energy transition and to change the current energy model; but in practice, the resources to do so are being placed in the hands of those who have grown rich on fossil fuels.

Thus, the main conclusion is that the projects that have benefited from more calls for proposals or have received larger amounts of money are led or formed by large energy multinationals. For example, Energías de Portugal (EDP), CEPSA, Repsol and Iberdrola, but also the investment fund Copenhagen Investment Partnership (CIP) and Fertiberia, the largest producer of fertiliser in the Spanish state.

EDP’s ‘Asturias H2 Valley’ project has benefited from the most calls: it has received a total award of 126 million euros, through the IDAE’s ‘Pioneers’ and ‘Value Chain’ calls, the IPCEI’s ‘Hy2Use’ and through the Innovation Fund. Another project of the same company, ‘Green H2 Los Barrios’, has also received 97 million euros.

However, the projects that have received the most funding have done so through a single call. The ‘Bilbao Large Scale Electrolyser’, the Puertollano fertiliser plant and the Catalina project received 160, 242 and 230 million euros respectively. The first two through the IPCEI HyUse calls, and the last one through the EHB.

In addition, in the ‘Strategic Project for Economic Recovery and Transformation (Spanish: PERTE)’ regarding ‘Renewable Energy, Hydrogen and Storage (Spanish: ERHA)’ and ‘Industrial Decarbonisation’, there is the possibility for a project to be allocated a grant directly, without competitive concurrence. This has been the case of ArcellorMittal, with a grant of 450 million euros to replace grey hydrogen with ‘green’ hydrogen in one of its steel plants. It has yet to accept it, as it has expressed doubts about it, and the company has even proposed that it would like to receive it even without implementing the transition to ‘green’ hydrogen.

METHODOLOGY

The two main difficulties in carrying out the analysis have been to discover the funds or institutions in charge of the calls for funding and, especially in the case of the Spanish state, the lack of transparency. The hydrogen projects financed by the Next Generation EU do so through the Strategic Projects for Economic Recovery and Transformation (PERTEs):

- PERTE for Renewable Energy, Hydrogen and Storage (Spanish: ERHA), managed by the Institute for Energy Diversification and Saving (Spanish: IDAE)

- PERTE for Industrial Decarbonisation, managed by the Ministry of Industry, Trade and Tourism.

It is also done through the call for Important Projects of Common European Interest (IPCEI). In the case of the IDAE’s ‘Pioneers’ and ‘Value chain’ programmes, the name of the companies involved in the project is not provided, but rather their CIF number; which hinders transparency, as it makes it necessary to look them up one by one to find out who is behind each numerical code. Furthermore, there are projects that have benefited from different calls and there are cases in which the name of the company and/or the names of the companies involved do not coincide.

The main objective of this document is to organise and clarify the different funds, calls and institutions in charge of managing the hydrogen beneficiary projects at the Spanish and European level that we have analysed in recent years. It is intended to be a living document, which will be updated as calls are resolved or new ones are launched.

The structure is simple. There is a first tab that summarises the calls currently open or already closed, identifying the fund from which the money will be allocated, the foreseen budget and the aid that has been granted. The funds destined to finance hydrogen projects at the Spanish and European level are:

- Next Generation EU, through the Recovery, Transformation and Resilience Plan

- Connecting Europe Facility

- EU Emission Trading System

- Innovation Fund

The budget and aid granted for each fund have been added up, as well as the total amount. For the European calls, only the aid granted to Spanish projects has been taken into account, indicating the corresponding percentage of the total budget. There is also a tab for each of the calls, with the same colour as in the summary tab. The items for each call are almost the same, except in the case of the electrolyzer funding, where the power of the electrolyzer and the associated renewable energies have been added.

To learn more about hydrogen, we recommend you other reports and materials that we have produced:

- ‘Hydrogen: the new panacea?’, in collaboration with Ecologistas en Acción

- Video capsule ‘Hydrogen cannot be the only solution’

- Video capsule series “Uncovering the green transition”

- ‘Hijacking the recovery through hydrogen’

- ‘Uncovering hydrogen projects financed by the Next Generation EU‘

- ‘Green hydrogen, a risk for food sovereignty in Catalonia’, in collaboration with Sobreranía Alimentaria